Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

Camarilla Pivots with exploration by MKP Manikandan for Amibroker (AFL)

Camarilla pivots developed by scott and used widely acrross globe. /This afl plots the exploration of all stocks levels for tomorrow trading.

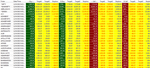

Screenshots

Indicator / Formula

//This AFL is created by Manikandan Ponraj with the intention of benefit to the people. Dedicate this to Manjula Kannan .

// for queries stockmarketq@gmail.com, stockmarketq.blogspot.in

_SECTION_BEGIN("Adv Camarilla Levels");

// Background color

SetChartOptions(0,chartShowArrows|chartShowDates);

SetChartBkGradientFill( ParamColor("BgTop", colorBlack),

ParamColor("BgBottom", colorBlack),ParamColor("titleblock",colorBlack ));

EntrySignal = C > ( LLV( L, 20 ) + 2 * ATR( 10 ) );

ExitSignal = C < ( HHV( H, 20 ) - 2 * ATR( 10 ) );

Color = IIf( EntrySignal, colorBlue, IIf( ExitSignal, colorRed, colorGrey50 ));

Plot( C, "Price", Color, styleCandle | styleThick );

//---- Camarilla pivot points

DayH = TimeFrameGetPrice("H", inDaily, -1);// yesterdays high

DayL = TimeFrameGetPrice("L", inDaily, -1);//low

DayC = TimeFrameGetPrice("C", inDaily, -1);//close

DayO = TimeFrameGetPrice("O", inDaily);// current day open

HiDay = TimeFrameGetPrice("H", inDaily);

LoDay = TimeFrameGetPrice("L", inDaily);

TimeFrameSet( inDaily );

H6 = (DayH / DayL) * DayC;

H5 = ((DayH - DayL)*0.782) + DayC;

H4 = (((DayH / DayL) + 0.83) / 1.83) * DayC;

H3 = ( ( (DayH / DayL) + 2.66) / 3.66) * DayC;

H2 = ( ( (DayH / DayL) + 4.5) / 5.5) * DayC;

H1 = ( ( (DayH / DayL) + 10) / 11) * DayC;

L1 = (2- ( ( (DayH / DayL) + 10) / 11)) * DayC;

L2 = (2-( (DayH / DayL) + 4.5) / 5.5) * DayC;

L3 = (2-(( DayH / DayL) + 2.66) / 3.66) * DayC;

L4 = (2-( (DayH / DayL) + 0.83) / 1.83) * DayC;

L5 = (DayC-( DayH - DayL)*0.782);

L6 = (2-( DayH / DayL)) * DayC;

case1=(O>L3) AND (O<H3);

case2=(O>H3) AND (O<H4);

case3=(O>L4) AND (O<L3);

case4=(O>H4);

case5=(O<L4);

ShowH5 = ParamToggle("H5", "No|Yes");

H5Color=ParamColor( "H5Color", colorGold );

ShowH4 = ParamToggle("H4", "yes|no");

H4Color=ParamColor( "H4Color", colorDarkRed );

ShowH3 = ParamToggle("H3", "yes|no");

H3Color=ParamColor( "H3Color", colorRed );

ShowH2 = ParamToggle("H2", "No|Yes");

H2Color=ParamColor( "H2Color", colorOrange );

ShowH1 = ParamToggle("H1", "No|Yes");

H1Color=ParamColor( "H1Color", colorOrange );

ShowL1 = ParamToggle("L1", "No|Yes");

L1Color=ParamColor( "L1Color", colorOrange );

ShowL2 = ParamToggle("L2", "No|Yes");

L2Color=ParamColor( "L2Color", colorOrange );

ShowL3 = ParamToggle("L3", "yes|no");

L3Color=ParamColor( "L3Color", colorGreen );

ShowL4 = ParamToggle("L4", "yes|no");

L4Color=ParamColor( "L4Color", colorDarkGreen );

ShowL5 = ParamToggle("L5", "No|Yes");

L5Color=ParamColor( "L5Color", colorGold );

//Shadowcolor = ParamColor("Shadow",ColorRGB(40,30,20));

//ShadowcoloH1 = ParamColor("Shadow1",ColorRGB(20,30,20));

//ShadowcoloH2 = ParamColor("Shadow2",ColorRGB(30,40,0));

numbars = LastValue(Cum(Status("barvisible")));

fraction= IIf(StrRight(Name(),3) == "",3.2,3.2);

hts = Param ("Text Shift", -50,-100,100,10);

PlotText(">>>" + WriteVal(C,fraction),

SelectedValue(BarIndex())-(numbars/hts),SelectedValue(C),1);

PlotText("Long at " + WriteVal(L3,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(L3),colorLime);

PlotText("B-Sell at " + WriteVal(L4,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(L4),colorOrange);

PlotText("Tar1= " + WriteVal(L5,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(L5),colorWhite);

PlotText("Tar2=" + WriteVal(L6,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(L6),colorWhite);

PlotText("Short at " + WriteVal(H3,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(H3),colorOrange);

PlotText("B-Buy " + WriteVal(H4,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(H4),colorLime);

PlotText("Tar= " + WriteVal(H5,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(H5),colorWhite);

PlotText("Tar= " + WriteVal(H6,fraction),SelectedValue(BarIndex()+2)-(numbars/hts),SelectedValue(H6),colorWhite);

//style = styleDots | styleThick + styleNoRescale ;

style = styleLine + styleNoRescale ;

if(ShowH5 == True)

Plot(H5, "H5",H5Color,style);

if(ShowH4 == False)

Plot(H4, "H4",H4Color,Style);

if(ShowH3 == False)

Plot(H3, "H3",H3Color,styleDots,styleThick,1);

if(ShowH2 == True)

Plot(H2, "H2",H2Color,styleLine);

if(ShowH1 == True)

Plot(H1, "H1",H1Color,styleLine);

if(ShowL1 == True)

Plot(L1, "L1",L1Color,styleLine);

if(ShowL2 == True)

Plot(L2, "L2",L2Color,styleLine);

if(ShowL3 == False)

Plot(L3, "L3",L3Color,styleDots,styleThick,1);

if(ShowL4 == False)

Plot(L4, "L4",L4Color,style);

if(ShowL5 == True)

Plot(L5, "L5",L5Color,style);

ToolTip=StrFormat("Open: %g\nHigh: %g\nLow: %g\nClose: %g (%.1f%%)\nVolume: "+NumToStr( V, 1 ), O, H, L, C, SelectedValue( ROC( C, 1)));

TimeFrameRestore();

Title = EncodeColor(colorWhite)+ "STOCKMARKETQ.BLOGSPOT.IN" + " - " + Name() + " - " + EncodeColor(colorWhite)+ Interval(2) + EncodeColor(colorWhite) +

" - " + Date() +" - " + "Open="+WriteVal(O)+" - " + "High="+WriteVal(H)+" - " + "Low="+WriteVal(L)+" - " + "Close="+WriteVal(C)+" - " + "Volume="+WriteVal(V);

_SECTION_END();

Filter=1;

AddColumn(L3,"---Buy---",1.2,colorWhite,colorDarkGreen,-1,Null);

AddColumn(H1,"Target1",1.2,colorBlue,colorYellow,-1,Null);

AddColumn(H2,"Target2",1.2,colorBlue,colorYellow,-1,Null);

AddColumn(L4,"Stoploss",1.2,colorRed,colorYellow,-1,Null);

AddColumn(H4,"B-Buy",1.2,colorWhite,colorDarkGreen,-1,Null);

AddColumn(H5,"Target1",1.2,colorBlue,colorYellow,-1,Null);

AddColumn(H6,"Target2",1.2,colorBlue,colorYellow,-1,Null);

AddColumn(H3,"Stoploss",1.2,colorRed,colorYellow,-1,Null);

AddColumn(H3,"---Sell---",1.2,colorWhite,colorDarkRed,-1,Null);

AddColumn(L1,"Target1",1.2,colorRed,colorYellow,-1,Null);

AddColumn(L2,"Target2",1.2,colorRed,colorYellow,-1,Null);

AddColumn(H4,"Stoploss",1.2,colorBlue,colorYellow,-1,Null);

AddColumn(L4,"B-Sell",1.2,colorWhite,colorDarkRed,-1,Null);

AddColumn(L5,"Target1",1.2,colorRed,colorYellow,-1,Null);

AddColumn(L6,"Target2",1.2,colorRed,colorYellow,-1,Null);

AddColumn(L3,"Stoploss",1.2,colorBlue,colorYellow,-1,Null);2 comments

Leave Comment

Please login here to leave a comment.

Back

shows error 16 – too many arguments

Are you still facing the error. If yes then u may use lower versions. If you face again then remove “null” from all the lines