Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

HARMONIC PATTERN DETECTION using ATR type Peaks and Troughs for Amibroker (AFL)

/* HARMONIC PATTERN DETECTION using ATR type Peaks and Troughs

Automatic Detection of Harmonic Patterns – Gartley, Bat, Butterfly and Crab.

Original code by joy.edakad@gmail.com, see:

http://www.inditraders.com/amibroker/1934-afl-harmonic-patterns.html

file: Harmonic1.1.afl (2009)

Modernized by E.M.Pottasch (Dec 2016).

- Using ATR based pivots instead of fractal based

- Improved visualisation of the patterns.

- Nomenclature of variables, constants and arrays, adjusted

following code from David Keleher.

- uncompleted pivots given white color

- multiple issues of the original code corrected for

The original code was based on “fractal type pivots”, this

code uses “ATR type pivots”. This code also includes a time

frame factor. To fully understand how to interpret a pattern

use the Amibroker playback utility and see how the patterns

develop. */

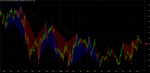

Screenshots

Indicator / Formula

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 299 300 301 302 303 304 305 306 307 308 309 310 311 312 313 314 315 316 317 318 319 320 321 322 323 324 325 326 327 328 329 330 331 332 333 334 335 336 337 338 339 340 341 342 343 344 345 346 347 348 349 350 351 352 353 354 355 356 357 358 359 360 361 362 363 364 365 366 367 368 369 370 371 372 373 374 375 376 377 378 379 380 381 382 383 384 385 386 387 388 389 390 391 392 393 394 395 396 397 398 399 400 401 402 403 404 405 406 407 408 409 410 411 412 413 414 415 416 417 418 419 420 421 422 423 424 425 426 427 428 429 430 431 432 433 434 435 436 437 438 439 440 441 442 443 444 445 446 447 448 449 450 451 452 453 454 455 456 457 458 459 460 461 462 463 464 465 466 467 468 469 470 471 472 473 474 475 476 477 478 479 480 481 482 483 484 485 486 487 488 489 490 491 492 493 494 495 496 497 498 499 500 501 502 503 504 505 506 507 508 509 510 511 512 513 514 515 516 517 518 519 520 521 522 523 524 525 526 527 528 529 530 531 532 533 534 535 536 537 538 539 540 541 542 543 544 545 546 547 548 549 550 551 552 553 554 555 556 557 558 559 560 561 562 563 564 565 566 567 568 569 570 571 572 573 574 575 576 577 578 579 580 581 582 583 584 585 586 587 588 589 590 591 592 593 594 595 596 597 598 599 600 601 602 603 604 605 606 607 608 609 610 611 612 613 | /* HARMONIC PATTERN DETECTION using ATR type Peaks and TroughsAutomatic Detection of Harmonic Patterns - Gartley, Bat, Butterfly and Crab.Original code by joy.edakad@gmail.com, see:http://www.inditraders.com/amibroker/1934-afl-harmonic-patterns.htmlfile: Harmonic1.1.afl (2009)Modernized by E.M.Pottasch (Dec 2016).- Using ATR based pivots instead of fractal based- Improved visualisation of the patterns.- Nomenclature of variables, constants and arrays, adjusted following code from David Keleher.- uncompleted pivots given white color - multiple issues of the original code corrected for The original code was based on "fractal type pivots", thiscode uses "ATR type pivots". This code also includes a timeframe factor. To fully understand how to interpret a patternuse the Amibroker playback utility and see how the patternsdevelop. */Version( 6.0 );GfxSetCoordsMode( 1 );GfxSetOverlayMode( 1 );BullBat4 = BullButterfly4 = BullCrab4 = BullGartley4 = 0;BullBat = BullButterfly = BullCrab = BullGartley = 0;BearBat4 = BearButterfly4 = BearCrab4 = BearGartley4 = 0;BearBat = BearButterfly = BearCrab = BearGartley = 0;pk = tr = pkn = trn = 0;bi = BarIndex();fvb = FirstVisibleValue( bi );lvb = LastVisibleValue( bi );GraphXSpace = 5;SetChartBkColor( colorBlack );SetChartOptions( 1, chartShowDates, chartGridMiddle, 0, 0, 0 );SetBarFillColor( IIf( C > O, ColorRGB( 0, 75, 0 ), IIf( C <= O, ColorRGB( 75, 0, 0 ), colorLightGrey ) ) );Plot( C, "", IIf( C > O, ColorRGB( 0, 255, 0 ), IIf( C <= O, ColorRGB( 255, 0, 0 ), colorLightGrey ) ), 64, Null, Null, 0, 0, 1 );_SECTION_BEGIN( "Patterns" );perBull = Param( "Bullish ATR Period", 20, 1, 150, 1 );perBear = Param( "Bearish ATR Period", 20, 1, 150, 1 );multBull = Param( "Bullish ATR Multiple", 2, 1, 4, 0.05 );multBear = Param( "Bearish ATR Multiple", 2, 1, 4, 0.05 );trailValueClose = ParamToggle( "Trail value", "High/Low|Close", 1 );//tfrm = in1Minute * Param( "Time Frame (min)", 5, 1, 1440 * 10, 1 ); // 1440 minutes is 1 daytfrm = in1Minute * Interval() / 60 * Param( "Chart Time Frame Factor", 1, 1, 10, 1 ); // factor 1 uses timeframe of chartshowATRPivots = ParamToggle( "Show ATR Pivots", "Off|On", 0 );showLabels = ParamToggle( "Show ATR Pivot Labels", "Off|On", 0 );bu = ParamToggle( "Show Bullish Pattern", "Off|On", 1 );be = ParamToggle( "Show Bearish Pattern", "Off|On", 1 );nBull = Param( "Max Number of Bullish Patterns", 10, 0, 100, 1 );nBear = Param( "Max Number of Bearish Patterns", 10, 0, 100, 1 );dBat = ParamToggle( "Draw Bat", "Off|On", 1 );dBut = ParamToggle( "Draw Buterfly", "Off|On", 1 );dCrab = ParamToggle( "Draw Crab", "Off|On", 1 );dGart = ParamToggle( "Draw Gartley", "Off|On", 1 );showPatternDevelopmentPoints = ParamToggle( "Show Points of Pattern Development", "Off|On", 1 );showPatternLabels = ParamToggle( "Show Pattern Labels", "Off|On", 0 );showPatternName = ParamToggle( "Show Pattern Name", "Off|On", 1 );_SECTION_END();_SECTION_BEGIN( "Gartley" );GBmin = Param( "Swing B Min.", 0.55, 0.3, 1, 0.01 );GBmax = Param( "Swing B Max.", 0.72, 0.4, 1, 0.01 );GCmin = Param( "Swing C Min.", 0.38, 0.3, 1.27, 0.01 );GCmax = Param( "Swing C Max.", 1.0, 0.4, 1.27, 0.01 );GDmin = Param( "Swing D Min.(XA)", 0.55, 0.3, 1, 0.01 );GDmax = Param( "Swing D Max.(XA)", 1.0, 0.4, 1.0, 0.01 );_SECTION_END();_SECTION_BEGIN( "Bat" );BatBmin = Param( "Swing B Min.", 0.38, 0.3, 1, 0.01 );BatBmax = Param( "Swing B Max.", 0.55, 0.4, 1, 0.01 );BatCmin = Param( "Swing C Min.", 0.38, 0.3, 1.62, 0.01 );BatCmax = Param( "Swing C Max.", 1.27, 0.4, 1.62, 0.01 );BatDmin = Param( "Swing D Min.(XA)", 0.5, 0.3, 1, 0.01 );BatDmax = Param( "Swing D Max.(XA)", 1.0, 0.4, 1.0, 0.01 );_SECTION_END();_SECTION_BEGIN( "Butterfly" );BtBmin = Param( "Swing B Min.", 0.55, 0.3, 1, 0.01 );BtBmax = Param( "Swing B Max.", 0.9, 0.4, 1, 0.01 );BtCmin = Param( "Swing C Min.", 0.38, 0.3, 1.62, 0.01 );BtCmax = Param( "Swing C Max.", 1.27, 0.4, 1.62, 0.01 );BtDmin = Param( "Swing D Min.(XA)", 1, 1, 1.8, 0.01 );BtDmax = Param( "Swing D Max.(XA)", 1.38, 1, 1.8, 0.01 );_SECTION_END();_SECTION_BEGIN( "Crab" );CBmin = Param( "Swing B Min.", 0.38, 0.3, 1, 0.01 );CBmax = Param( "Swing B Max.", 0.65, 0.4, 1, 0.01 );CCmin = Param( "Swing C Min.", 0.38, 0.3, 1.62, 0.01 );CCmax = Param( "Swing C Max.", 1.270, 0.4, 1.62, 0.01 );CDmin = Param( "Swing D Min.(XA)", 1.25, 1, 1.8, 0.01 );CDmax = Param( "Swing D Max.(XA)", 1.8, 1, 2, 0.01 );_SECTION_END();function ATRtrail_func(){ // Trail code largely from: // http://traders.com/Documentation/FEEDbk_docs/2009/06/TradersTips.html if( trailValueClose ) { tvHigh = C; tvLow = C; } else { tvHigh = H; tvLow = L; } sup = tvHigh - multBull * ATR( perBull ); res = tvLow + multBear * ATR( perBear ); trailARRAY = Null; trailstop = 0; for( i = 1; i < BarCount; i++ ) { if( C[ i ] > trailstop AND C[ i - 1 ] > trailstop ) trailstop = Max( trailstop, sup[ i ] ); else if( C[ i ] < trailstop AND C[ i - 1 ] < trailstop ) trailstop = Min( trailstop, res[ i ] ); else trailstop = IIf( C[ i ] > trailstop, sup[ i ], res[ i ] ); trailARRAY[ i ] = trailstop; } return trailARRAY;}TimeFrameSet( tfrm );trBull = multBull * ATR( perBull );trBear = multBear * ATR( perBear );trailArray = ATRtrail_func();ts = IIf( trailArray > C, trailArray, Null ); // dntrendtl = IIf( trailArray < C, trailArray, Null ); // uptrendTimeFrameRestore();ts = TimeFrameExpand( ts, tfrm, expandlast );tl = TimeFrameExpand( tl, tfrm, expandlast );lll = LLV( L, BarsSince( !IsEmpty( tl ) ) );lll = IIf( ts, lll, Null );trn = ts AND L == lll;hhh = HHV( H, BarsSince( !IsEmpty( ts ) ) );hhh = IIf( tl, hhh, Null );pkn = tl AND H == hhh;tr = ExRem( Reverse( trn ), Reverse( pkn ) );pk = ExRem( Reverse( pkn ), Reverse( trn ) );tr = Reverse( tr );pk = Reverse( pk );for( i = 0; i < 3; i++ ){ VarSet( "px" + i, ValueWhen( pk, bi, i ) ); VarSet( "tx" + i, ValueWhen( tr, bi, i ) ); VarSet( "ph" + i, ValueWhen( pk, H, i ) ); VarSet( "tl" + i, ValueWhen( tr, L, i ) );}ll = tr AND tl1 < tl2;hl = tr AND tl1 > tl2;hh = pk AND ph1 > ph2;lh = pk AND ph1 < ph2;dt = pk AND ph1 == ph2;db = tr AND tl1 == tl2;if( showATRPivots ){ PlotShapes( shapeSmallCircle * tr, IIf( tx1 < px0, ColorRGB( 0, 0, 255 ), colorWhite ), 0, L, -10 ); PlotShapes( shapeSmallCircle * pk, IIf( px1 < tx0, ColorRGB( 255, 0, 0 ), colorWhite ), 0, H, 10 );}// +++ Bullish PatternsPTvalid = ( px1 > tx1 AND tx1 > px2 AND px2 > tx2 ) AND pk;if( dGart AND bu ){ BullGartley4 = PTvalid AND( ph2 - tl1 ) / ( ph2 - tl2 ) > GBmin AND( ph2 - tl1 ) / ( ph2 - tl2 ) < GBmax AND( ph1 - tl1 ) / ( ph2 - tl1 ) > GCMin AND( ph1 - tl1 ) / ( ph2 - tl1 ) < GCMax; BullGartley = IIf( Nz( LowestSince( BullGartley4, L ) ) < Nz( ValueWhen( BullGartley4, ph2 ) ) - ( Nz( ValueWhen( BullGartley4, ph2 ) ) - Nz( ValueWhen( BullGartley4, tl2 ) ) ) * GDmin AND Nz( LowestSince( bullGartley4, L ) ) > Nz( ValueWhen( BullGartley4, ph2 ) ) - ( Nz( ValueWhen( BullGartley4, ph2 ) ) - Nz( ValueWhen( BullGartley4, tl2 ) ) ) * GDmax AND Nz( HighestSince( BullGartley4, H ) ) <= Nz( ValueWhen( BullGartley4, ph1 ) ) AND Nz( LowestSince( BullGartley4, L ) ) < Nz( ValueWhen( BullGartley4, tl1 ) ) AND Nz( trn ) AND Nz( LowestSince( bullGartley4, L ) ) == L, True, False );}if( dBat AND bu ){ BullBat4 = PTvalid AND( ph2 - tl1 ) / ( ph2 - tl2 ) > BatBmin AND( ph2 - tl1 ) / ( ph2 - tl2 ) < BatBmax AND( ph1 - tl1 ) / ( ph2 - tl1 ) > BatCMin AND( ph1 - tl1 ) / ( ph2 - tl1 ) < BatCMax; BullBat = IIf( Nz( LowestSince( BullBat4, L ) ) < Nz( ValueWhen( BullBat4, ph2 ) ) - ( Nz( ValueWhen( BullBat4, ph2 ) ) - Nz( ValueWhen( BullBat4, tl2 ) ) ) * BatDmin AND Nz( LowestSince( BullBat4, L ) ) > Nz( ValueWhen( BullBat4, ph2 ) ) - ( Nz( ValueWhen( BullBat4, ph2 ) ) - Nz( ValueWhen( BullBat4, tl2 ) ) ) * BatDmax AND Nz( HighestSince( BullBat4, H ) ) <= Nz( ValueWhen( BullBat4, ph1 ) ) AND Nz( LowestSince( BullBat4, L ) ) < Nz( ValueWhen( BullBat4, tl1 ) ) AND Nz( trn ) AND Nz( LowestSince( BullBat4, L ) ) == L, True, False );}if( dBut AND bu ){ BullButterfly4 = PTvalid AND( ph2 - tl1 ) / ( ph2 - tl2 ) > BtBmin AND( ph2 - tl1 ) / ( ph2 - tl2 ) < BtBMax AND( ph1 - tl1 ) / ( ph2 - tl1 ) > BtCmin AND( ph1 - tl1 ) / ( ph2 - tl1 ) < BtCmax; BullButterfly = IIf( Nz( LowestSince( BullButterfly4, L ) ) < Nz( ValueWhen( BullButterfly4, ph2 ) ) - ( Nz( ValueWhen( BullButterfly4, ph2 ) ) - Nz( ValueWhen( BullButterfly4, tl2 ) ) ) * BtDMin AND Nz( LowestSince( BullButterfly4, L ) ) > Nz( ValueWhen( BullButterfly4, ph2 ) ) - ( Nz( ValueWhen( BullButterfly4, ph2 ) ) - Nz( ValueWhen( BullButterfly4, tl2 ) ) ) * BtDmax AND Nz( HighestSince( BullButterfly4, H ) ) <= Nz( ValueWhen( BullButterfly4, ph1 ) ) AND Nz( LowestSince( BullButterfly4, L ) ) < Nz( ValueWhen( BullButterfly4, tl2 ) ) AND Nz( trn ) AND Nz( LowestSince( bullButterfly4, L ) ) == L, True, False );}if( dCrab AND bu ){ BullCrab4 = PTvalid AND( ph2 - tl1 ) / ( ph2 - tl2 ) > CBmin AND( ph2 - tl1 ) / ( ph2 - tl2 ) < CBmax AND( ph1 - tl1 ) / ( ph2 - tl1 ) > CCmin AND( ph1 - tl1 ) / ( ph2 - tl1 ) < CCmax; BullCrab = IIf( Nz( LowestSince( BullCrab4, L ) ) < Nz( ValueWhen( BullCrab4, ph2 ) ) - ( Nz( ValueWhen( BullCrab4, ph2 ) ) - Nz( ValueWhen( BullCrab4, tl2 ) ) ) * CDmin AND Nz( LowestSince( BullCrab4, L ) ) > Nz( ValueWhen( BullCrab4, ph2 ) ) - ( Nz( ValueWhen( BullCrab4, ph2 ) ) - Nz( ValueWhen( BullCrab4, tl2 ) ) ) * CDmax AND Nz( HighestSince( BullCrab4, H ) ) <= Nz( ValueWhen( BullCrab4, ph1 ) ) AND Nz( LowestSince( BullCrab4, L ) ) < Nz( ValueWhen( BullCrab4, tl2 ) ) AND Nz( trn ) AND Nz( LowestSince( bullGartley4, L ) ) == L, True, False );}BullCrab = BullCrab AND IIf( Nz( ValueWhen( BullCrab4, bi ) ) >= Nz( ValueWhen( BullGartley4, bi ) ) AND Nz( ValueWhen( BullCrab4, bi ) ) >= Nz( ValueWhen( BullBat4, bi ) ) AND Nz( ValueWhen( BullCrab4, bi ) ) >= Nz( ValueWhen( BullButterfly4, bi ) ), 1, 0 );BullBat = BullBat AND IIf( Nz( ValueWhen( BullBat4, bi ) ) >= Nz( ValueWhen( BullGartley4, bi ) ) AND Nz( ValueWhen( BullBat4, bi ) ) >= Nz( ValueWhen( BullCrab4, bi ) ) AND Nz( ValueWhen( BullBat4, bi ) ) >= Nz( ValueWhen( BullButterfly4, bi ) ), 1, 0 );BullButterfly = BullButterfly AND IIf( Nz( ValueWhen( BullButterfly4, bi ) ) >= Nz( ValueWhen( BullGartley4, bi ) ) AND Nz( ValueWhen( BullButterfly4, bi ) ) >= Nz( ValueWhen( BullCrab4, bi ) ) AND Nz( ValueWhen( BullButterfly4, bi ) ) >= Nz( ValueWhen( BullBat4, bi ) ), 1, 0 );BullGartley = BullGartley AND IIf( Nz( ValueWhen( BullGartley4, bi ) ) >= Nz( ValueWhen( BullBat4, bi ) ) AND Nz( ValueWhen( BullGartley4, bi ) ) >= Nz( ValueWhen( BullCrab4, bi ) ) AND Nz( ValueWhen( BullGartley4, bi ) ) >= Nz( ValueWhen( BullButterfly4, bi ) ), 1, 0 );BullHar4 = BullGartley4 OR BullButterfly4 OR BullBat4 OR BullCrab4 ;BullHar = BullGartley OR BullButterfly OR BullBat OR BullCrab ;buXy = ValueWhen( BullHar4, tl2 );buXx = ValueWhen( BullHar4, tx2 );buAy = ValueWhen( BullHar4, ph2 );buAx = ValueWhen( BullHar4, px2 );buBy = ValueWhen( BullHar4, tl1 );buBx = ValueWhen( BullHar4, tx1 );buCy = ValueWhen( BullHar4, ph1 );buCx = ValueWhen( BullHar4, px1 );buDy = ValueWhen( BullHar, L );buDx = ValueWhen( BullHar, bi );buABdXA = ( buAy - buBy ) / ( buAy - buXy );buBCdAB = ( buCy - buBy ) / ( buAy - buBy );buADdXA = ( buAy - buDy ) / ( buAy - buXy );buBCdCD = ( buCy - buDy ) / ( buCy - buBy );function drawBullishPattern( i, patternName ){ GfxSelectSolidBrush( ColorRGB( 0, 0, 50 ) ); GfxSetBkColor( colorBlack ); GfxSelectPen( ColorRGB( 0, 0, 255 ), 2, 0 ); GfxMoveTo( buXx[i], buXy[i] ); GfxLineTo( buAx[i], buAy[i] ); GfxMoveTo( buAx[i], buAy[i] ); GfxLineTo( buBx[i], buBy[i] ); GfxMoveTo( buBx[i], buBy[i] ); GfxLineTo( buCx[i], buCy[i] ); GfxMoveTo( buCx[i], buCy[i] ); GfxLineTo( buDx[i], buDy[i] ); GfxMoveTo( buXx[i], buXy[i] ); GfxLineTo( buAx[i], buAy[i] ); GfxSelectPen( ColorRGB( 0, 0, 255 ), 1, 2 ); GfxMoveTo( buXx[i], buXy[i] ); GfxLineTo( buBx[i], buBy[i] ); GfxMoveTo( buAx[i], buAy[i] ); GfxLineTo( buCx[i], buCy[i] ); GfxMoveTo( buBx[i], buBy[i] ); GfxLineTo( buDx[i], buDy[i] ); GfxMoveTo( buXx[i], buXy[i] ); GfxLineTo( buDx[i], buDy[i] ); GfxPolygon( buXx[i], buXy[i], buAx[i], buAy[i], buBx[i], buBy[i], buCx[i], buCy[i], buDx[i], buDy[i], buBx[i], buBy[i], buXx[i], buXy[i] ); if( showPatternName ) { GfxSetTextColor( ColorRGB( 0, 0, 0 ) ); GfxSelectFont( "Helvetica", 10, 700 ); GfxSetBkColor( ColorRGB( 0, 0, 255 ) ); GfxSetTextAlign( 0 | 8 ); GfxTextOut( patternName, buCx[i] + 3, buCy[i] ); } GfxSetTextAlign( 0 | 0 ); GfxSetTextColor( ColorRGB( 0, 0, 255 ) ); GfxSetBkColor( ColorRGB( 0, 0, 0 ) ); GfxSelectFont( "Helvetica", 8, 700 ); GfxTextOut( "" + Prec( buABdXA[i], 2 ), ( buBx[i] + buXx[i] ) / 2, ( buBy[i] + buXy[i] ) / 2 ); GfxTextOut( "" + Prec( buBCdAB[i], 2 ), ( buCx[i] + buAx[i] ) / 2, ( buCy[i] + buAy[i] ) / 2 ); GfxTextOut( "" + Prec( buADdXA[i], 2 ), ( buDx[i] + buXx[i] ) / 2, ( buDy[i] + buXy[i] ) / 2 ); GfxTextOut( "" + Prec( buBCdCD[i], 2 ), ( buBx[i] + buDx[i] ) / 2, ( buBy[i] + buDy[i] ) / 2 ); if( showPatternLabels ) { GfxSetTextColor( ColorRGB( 0, 0, 0 ) ); GfxSelectFont( "Helvetica", 9, 700 ); GfxSetBkColor( ColorRGB( 0, 0, 255 ) ); GfxSetTextAlign( 0 | 24 ); GfxTextOut( "X", buXx[i] - 2, buXy[i] ); GfxTextOut( "A", buAx[i] - 2, buAy[i] ); GfxTextOut( "B", buBx[i] - 2, buBy[i] ); GfxTextOut( "C", buCx[i] + 1, buCy[i] ); GfxTextOut( "D", buDx[i] + 1, buDy[i] ); }}function drawBullishPatterns(){ flag1 = 1; flag2 = 0; cnt = 0; for( i = lvb; i > fvb; i-- ) { if( BullHar[i] AND flag1 AND cnt < nBull ) { flag1 = 0; flag2 = 1; cnt = cnt + 1; if( BullButterfly[i] AND bu AND dBut ) { drawBullishPattern( i, "Bullish Butterfly" ); } if( BullCrab[i] AND bu AND dCrab ) { drawBullishPattern( i, "Bullish Crab" ); } if( BullBat[i] AND bu AND dBat ) { drawBullishPattern( i, "Bullish Bat" ); } if( BullGartley[i] AND bu AND dGart ) { drawBullishPattern( i, "Bullish Gartley" ); } } if( BullHar4[i] AND flag2 ) { flag1 = 1; flag2 = 0; } }}drawBullishPatterns();// +++ Bearish PatternsPTvalid = ( tx1 > px1 AND px1 > tx2 AND tx2 > px2 ) AND tr;if( dGart AND be ){ BearGartley4 = PTvalid AND( ph1 - tl2 ) / ( ph2 - tl2 ) > GBmin AND( ph1 - tl2 ) / ( ph2 - tl2 ) < GBmax AND ( ph1 - tl1 ) / ( ph1 - tl2 ) > GCmin AND( ph1 - tl1 ) / ( ph1 - tl2 ) < GCmax; BearGartley = IIf( Nz( HighestSince( bearGartley4, H ) ) > Nz( ValueWhen( BearGartley4, tl2 ) ) + ( Nz( ValueWhen( BearGartley4, ph2 ) ) - Nz( ValueWhen( BearGartley4, tl2 ) ) ) * GDmin AND Nz( HighestSince( bearGartley4, H ) ) < Nz( ValueWhen( BearGartley4, tl2 ) ) + ( Nz( ValueWhen( BearGartley4, ph2 ) ) - Nz( ValueWhen( BearGartley4, tl2 ) ) ) * GDMax AND Nz( LowestSince( BearGartley4, L ) ) >= Nz( ValueWhen( BearGartley4, tl1 ) ) AND Nz( HighestSince( BearGartley4, H ) ) > Nz( ValueWhen( BearGartley4, ph1 ) ) AND Nz( pkn ) AND Nz( HighestSince( BearGartley4, H ) ) == H, True, False );}if( dBat AND be ){ BearBat4 = PTvalid AND( ph1 - tl2 ) / ( ph2 - tl2 ) > BatBmin AND( ph1 - tl2 ) / ( ph2 - tl2 ) < BatBmax AND ( ph1 - tl1 ) / ( ph1 - tl2 ) > BatCmin AND( ph1 - tl1 ) / ( ph1 - tl2 ) < BatCmax; BearBat = IIf( Nz( HighestSince( BearBat4, H ) ) > Nz( ValueWhen( BearBat4, tl2 ) ) + ( Nz( ValueWhen( BearBat4, ph2 ) ) - Nz( ValueWhen( BearBat4, tl2 ) ) ) * BatDmin AND Nz( HighestSince( BearBat4, H ) ) < Nz( ValueWhen( BearBat4, tl2 ) ) + ( Nz( ValueWhen( BearBat4, ph2 ) ) - Nz( ValueWhen( BearBat4, tl2 ) ) ) * BatDMax AND Nz( LowestSince( BearBat4, L ) ) >= Nz( ValueWhen( BearBat4, tl1 ) ) AND Nz( HighestSince( BearBat4, H ) ) > Nz( ValueWhen( BearBat4, ph1 ) ) AND Nz( pkn ) AND Nz( HighestSince( BearBat4, H ) ) == H, True, False );}if( dBut AND be ){ BearButterfly4 = PTvalid AND( ph1 - tl2 ) / ( ph2 - tl2 ) > BtBmin AND( ph1 - tl2 ) / ( ph2 - tl2 ) < BtBmax AND ( ph1 - tl1 ) / ( ph1 - tl2 ) > BtCmin AND( ph1 - tl1 ) / ( ph1 - tl2 ) < BtCmax; BearButterfly = IIf( Nz( HighestSince( BearButterfly4, H ) ) > Nz( ValueWhen( BearButterfly4, tl2 ) ) + ( Nz( ValueWhen( BearButterfly4, ph2 ) ) - Nz( ValueWhen( BearButterfly4, tl2 ) ) ) * BtDmin AND Nz( HighestSince( BearButterfly4, H ) ) < Nz( ValueWhen( BearButterfly4, tl2 ) ) + ( Nz( ValueWhen( BearButterfly4, ph2 ) ) - Nz( ValueWhen( BearButterfly4, tl2 ) ) ) * BtDMax AND Nz( LowestSince( BearButterfly4, L ) ) >= Nz( ValueWhen( BearButterfly4, tl1 ) ) AND Nz( HighestSince( BearButterfly4, H ) ) > Nz( ValueWhen( BearButterfly4, ph2 ) ) AND Nz( pkn ) AND Nz( HighestSince( BearButterfly4, H ) ) == H, True, False );}if( dCrab AND be ){ BearCrab4 = PTvalid AND( ph1 - tl2 ) / ( ph2 - tl2 ) > CBmin AND( ph1 - tl2 ) / ( ph2 - tl2 ) < CBmax AND ( ph1 - tl1 ) / ( ph1 - tl2 ) > CCmin AND( ph1 - tl1 ) / ( ph1 - tl2 ) < CCmax; BearCrab = IIf( Nz( HighestSince( BearCrab4, H ) ) > Nz( ValueWhen( BearCrab4, tl2 ) ) + ( Nz( ValueWhen( BearCrab4, ph2 ) ) - Nz( ValueWhen( BearCrab4, tl2 ) ) ) * CDmin AND Nz( HighestSince( BearCrab4, H ) ) < Nz( ValueWhen( BearCrab4, tl2 ) ) + ( Nz( ValueWhen( BearCrab4, ph2 ) ) - Nz( ValueWhen( BearCrab4, tl2 ) ) ) * CDMax AND Nz( LowestSince( BearCrab4, L ) ) >= Nz( ValueWhen( BearCrab4, tl1 ) ) AND Nz( HighestSince( BearCrab4, H ) ) > Nz( ValueWhen( BearCrab4, ph2 ) ) AND Nz( pkn ) AND Nz( HighestSince( BearCrab4, H ) ) == H, True, False );}BearCrab = BearCrab AND IIf( Nz( ValueWhen( BearCrab4, bi ) ) >= Nz( ValueWhen( BearGartley4, bi ) ) AND Nz( ValueWhen( BearCrab4, bi ) ) >= Nz( ValueWhen( BearBat4, bi ) ) AND Nz( ValueWhen( BearCrab4, bi ) ) >= Nz( ValueWhen( BearButterfly4, bi ) ), 1, 0 );BearBat = BearBat AND IIf( Nz( ValueWhen( BearBat4, bi ) ) >= Nz( ValueWhen( BearGartley4, bi ) ) AND Nz( ValueWhen( BearBat4, bi ) ) >= Nz( ValueWhen( BearCrab4, bi ) ) AND Nz( ValueWhen( BearBat4, bi ) ) >= Nz( ValueWhen( BearButterfly4, bi ) ), 1, 0 );BearButterfly = BearButterfly AND IIf( Nz( ValueWhen( BearButterfly4, bi ) ) >= Nz( ValueWhen( BearGartley4, bi ) ) AND Nz( ValueWhen( BearButterfly4, bi ) ) >= Nz( ValueWhen( BearCrab4, bi ) ) AND Nz( ValueWhen( BearButterfly4, bi ) ) >= Nz( ValueWhen( BearBat4, bi ) ), 1, 0 );BearGartley = BearGartley AND IIf( Nz( ValueWhen( BearGartley4, bi ) ) >= Nz( ValueWhen( BearBat4, bi ) ) AND Nz( ValueWhen( BearGartley4, bi ) ) >= Nz( ValueWhen( BearCrab4, bi ) ) AND Nz( ValueWhen( BearGartley4, bi ) ) >= Nz( ValueWhen( BearButterfly4, bi ) ), 1, 0 );BearHar4 = BearGartley4 OR BearButterfly4 OR BearBat4 OR BearCrab4 ;BearHar = BearGartley OR BearButterfly OR BearBat OR BearCrab ;beXy = ValueWhen( BearHar4, ph2 );beXx = ValueWhen( BearHar4, px2 );beAy = ValueWhen( BearHar4, tl2 );beAx = ValueWhen( BearHar4, tx2 );beBy = ValueWhen( BearHar4, ph1 );beBx = ValueWhen( BearHar4, px1 );beCy = ValueWhen( BearHar4, tl1 );beCx = ValueWhen( BearHar4, tx1 );beDy = ValueWhen( BearHar, H );beDx = ValueWhen( BearHar, bi );beABdXA = ( beBy - beAy ) / ( beXy - beAy );beBCdAB = ( beBy - beCy ) / ( beBy - beAy );beADdXA = ( beDy - beAy ) / ( beXy - beAy );beBCdCD = ( beDy - beCy ) / ( beBy - beCy );function drawBearishPattern( i, patternName ){ GfxSelectSolidBrush( ColorRGB( 50, 0, 0 ) ); GfxSetBkColor( colorBlack ); GfxSelectPen( ColorRGB( 255, 0, 0 ), 2, 0 ); GfxMoveTo( beXx[i], beXy[i] ); GfxLineTo( beAx[i], beAy[i] ); GfxMoveTo( beAx[i], beAy[i] ); GfxLineTo( beBx[i], beBy[i] ); GfxMoveTo( beBx[i], beBy[i] ); GfxLineTo( beCx[i], beCy[i] ); GfxMoveTo( beCx[i], beCy[i] ); GfxLineTo( beDx[i], beDy[i] ); GfxMoveTo( beXx[i], beXy[i] ); GfxLineTo( beAx[i], beAy[i] ); GfxSelectPen( ColorRGB( 255, 0, 0 ), 1, 2 ); GfxMoveTo( beXx[i], beXy[i] ); GfxLineTo( beBx[i], beBy[i] ); GfxMoveTo( beAx[i], beAy[i] ); GfxLineTo( beCx[i], beCy[i] ); GfxMoveTo( beBx[i], beBy[i] ); GfxLineTo( beDx[i], beDy[i] ); GfxMoveTo( beXx[i], beXy[i] ); GfxLineTo( beDx[i], beDy[i] ); GfxPolygon( beXx[i], beXy[i], beAx[i], beAy[i], beBx[i], beBy[i], beCx[i], beCy[i], beDx[i], beDy[i], beBx[i], beBy[i], beXx[i], beXy[i] ); if( showPatternName ) { GfxSetTextColor( ColorRGB( 0, 0, 0 ) ); GfxSelectFont( "Helvetica", 10, 700 ); GfxSetBkColor( ColorRGB( 255, 0, 0 ) ); GfxSetTextAlign( 0 | 0 ); GfxTextOut( patternName, beCx[i] + 3, beCy[i] ); } GfxSetTextAlign( 0 | 0 ); GfxSetTextColor( ColorRGB( 255, 0, 0 ) ); GfxSetBkColor( ColorRGB( 0, 0, 0 ) ); GfxSelectFont( "Helvetica", 8, 700 ); GfxTextOut( "" + Prec( beABdXA[i], 2 ), ( beBx[i] + beXx[i] ) / 2, ( beBy[i] + beXy[i] ) / 2 ); GfxTextOut( "" + Prec( beBCdAB[i], 2 ), ( beCx[i] + beAx[i] ) / 2, ( beCy[i] + beAy[i] ) / 2 ); GfxTextOut( "" + Prec( beADdXA[i], 2 ), ( beDx[i] + beXx[i] ) / 2, ( beDy[i] + beXy[i] ) / 2 ); GfxTextOut( "" + Prec( beBCdCD[i], 2 ), ( beBx[i] + beDx[i] ) / 2, ( beBy[i] + beDy[i] ) / 2 ); if( showPatternLabels ) { GfxSetTextColor( ColorRGB( 0, 0, 0 ) ); GfxSelectFont( "Helvetica", 9, 700 ); GfxSetBkColor( ColorRGB( 255, 0, 0 ) ); GfxSetTextAlign( 0 | 24 ); GfxTextOut( "X", beXx[i] - 2, beXy[i] ); GfxTextOut( "A", beAx[i] - 2, beAy[i] ); GfxTextOut( "B", beBx[i] - 2, beBy[i] ); GfxTextOut( "C", beCx[i] + 1, beCy[i] ); GfxTextOut( "D", beDx[i] + 1, beDy[i] ); }}function drawBearishPatterns(){ flag1 = 1; flag2 = 0; cnt = 0; for( i = lvb; i > fvb; i-- ) { if( BearHar[i] AND flag1 AND cnt < nBear ) { flag1 = 0; flag2 = 1; cnt = cnt + 1; if( BearButterfly[i] AND be AND dBut ) { drawBearishPattern( i, "Bearish Butterfly" ); } if( BearCrab[i] AND be AND dCrab ) { drawBearishPattern( i, "Bearish Crab" ); } if( BearBat[i] AND be AND dBat ) { drawBearishPattern( i, "Bearish Bat" ); } if( BearGartley[i] AND be AND dGart ) { drawBearishPattern( i, "Bearish Gartley" ); } } if( BearHar4[i] AND flag2 ) { flag1 = 1; flag2 = 0; } }}drawBearishPatterns();function drawPivotLabels(){ sz = 5; for( i = lvb; i > fvb; i-- ) { { if( ll[i] ) PlotTextSetFont( "LL", "Arial Black", sz, i, L[i], colorBlue, colorDefault, -25 ); if( hl[i] ) PlotTextSetFont( "HL", "Arial Black", sz, i, L[i], colorBlue, colorDefault, -25 ); if( db[i] ) PlotTextSetFont( "DB", "Arial Black", sz, i, L[i], colorLightBlue, colorDefault, -25 ); if( hh[i] ) PlotTextSetFont( "HH", "Arial Black", sz, i, H[i], colorRed, colorDefault, 20 ); if( lh[i] ) PlotTextSetFont( "LH", "Arial Black", sz, i, H[i], colorRed, colorDefault, 20 ); if( dt[i] ) PlotTextSetFont( "DT", "Arial Black", sz, i, H[i], colorOrange, colorDefault, 20 ); } }}if( showLabels ) drawPivotLabels();if( showPatternDevelopmentPoints ){ if( bu ) { PlotShapes( shapeDigit4 * BullHar4, colorBlue, O, H, 35 ); PlotShapes( shapeSmallCircle * BullHar, ColorLightBlue, O, L, -10 ); } if( be ) { PlotShapes( shapeDigit4 * BearHar4, colorRed, O, L, -35 ); PlotShapes( shapeSmallCircle * BearHar, colorOrange, O, H, 10 ); }}Title = Name() + " | " + Now( 2 ) + " | " + "PIVOT TIMEFRAME: " + tfrm / 60 + " Minutes or " + tfrm / 3600 + " Hours or " + tfrm / ( 3600 * 24 ) + " Days "; |

24 comments

Leave Comment

Please login here to leave a comment.

Back

Will check

made a minor change in the display of the patterns:

http://wisestocktrader.com/indicatorpasties/1748-harmonic-pattern-+-atr-piv-update

error in formula detect on ami 6

my gosh you guys, I am shocked this is all I get, “error in formula”. I guess this will be my last post. Quite frankly this is superb code. But this will be the last I post, fed up with these “error in formula” posts and people just not responding. Why do you think I post this? Just for the idiots. Good luck

Dear Mr. Pottasch,

Please stay!

“I”, and I’m sure “WE” all, value your studies and afl sharing. Albeit, this is not a discussion board, so often reports are curt with no further explanation. This is compounded by the fact that most, if not all Wisestocktrader members, have English as a secondary language, which in itself creates issues in formula coding. Some probably cannot write English and are too shy to express themselves in descriptive sentences.

Please DO remain here, and continue to post your valuable experience, insight and afl codes.

With appreciation and gratefully yours – ‘Parfumeur’ in PA, USA

Thanks for the great formula! I hope you will stay too. There are definitely those of us who appreciate what you have posted.

you do whatever you want,but letting your emotions fall prey to they posts of error codes is demeening to all of us that know your ideas and programming skills are unequalled here or anywhere else. Do not let yourself fall prey to those that are jellous of your skill. Best of luck and good health in 2017

Thank you, Mr. Pottasch for your brilliant formula.

That is how formulas should be coded.

What I noticed: Bearish Crab overwritten on Bearish Butterfly.

(We shall study the formula and improve it a little.)

Good luck !

ok guys, thanks for the replies, I lost my cool a bit here (never post a comment when drinking beer ….).

with respect to double names, crab overwritten on Butterfly. Yes that sometimes may occur. Try to do a playback. Then you will see that first the Butterfly will appear and later the Crab will appear. In some cases both patterns are valid. This is how it is setup. This is done not by me but by the original author with respect to the parameter constraints. These patterns are only distinguished by the retracement ratios.

This is one of the points I am still working on. The original author uses ranges like GBmin en GBmax. But I am not sure if this is correct and it is hard to figure out what one needs to use. Like in Scott Carneys book Vol1 he says that for a Gartley B retracement over leg XA should be a precise 61.8%. In the code I posted a range is used => 55% to 72%. Maybe this is good enough.

thank you so much for a nice piece of code and for your time .

Crave, will post latest code soon

this is the latest code on this.

it includes entry zones using the parameter settings

http://wisestocktrader.com/indicatorpasties/1754-harmonics-plus-zones

sometimes you see 1 pattern and multiple zones. To understand this do Playback. I only draw the latest pattern originating from point C. But sometimes a pattern starts off as a gartley, moves to a Butterfly and then a Crab. All these zones are displayd but not all the patterns, since this would get messy.

Thank you Ed, This is amazing code! Mark

someone found small error, corrected for:

http://wisestocktrader.com/indicatorpasties/1755-harmonics-plus-zones-2

Thank you for taking the time to code this. It is greatly appreciated.

I was wondering if the script like this one is as reliable as manual harmonic pattern detection, done by a decent human trader ?

so far I did not do any tests with these patterns. I just use the parameter constraints the original author uses. But it would be great to get feedback from people who actually use these type of patterns for trading. Or maybe someone just uses 1 type of pattern and has more information about the parameters to use.

I have just been eyeballing the patterns and the impression I get is that the Gartley and Bat (and to lesser extent the Butterfly) seem to be most reliable especially as a trend continuation pattern

on some bars there were more than 1 pattern, like a Crab and a Butterfly. This sometimes led to a mess when drawing the entry zones. I now removed any overlap

http://wisestocktrader.com/indicatorpasties/1757-harmonics-plus-zones-overlap-removed

dear empottasch is it possible to add exploration code with this chart so that we can scan the stocks to detect potential harmonic patterns with PRZ?

hi

the formula has many error up till now

1st error in line 6

thanks

Sir,

does this http://wisestocktrader.com/indicatorpasties/1755-harmonics-plus-zones-2 supersedes previous versions ?

thanks

hello sir.

can yo help me how to use this in amibroker 6?

i got error.

thanks

GOD Level work, Thank you very much Mr. empottasch :)

Hi,i tried this on my ami..but it doesnt work :(

Hello Empottasch, I found your code snippets in this topic: https://forum.amibroker.com/t/how-to-get-the-most-traded-area-value-of-previous-day-intraday-data/2472/56, and I’m really glad to have come across them. First of all, I want to thank you for writing those lines of code. Since the topic is closed, I’m reaching out to you here to ask for your opinion on the Volume Profile. I have used that code and it has been really helpful for me. However, I don’t know how to retrieve the values of POC (Point of Control), VAL (Value Area Low), and VAH (Value Area High) for specific years using Amibroker’s Analysis. For example, how can I retrieve those values for the previous year? And when the price crosses POC, VAL, or VAH, how can I utilize Analysis? I truly appreciate your answer. I am new to Amibroker, and this part is quite challenging for me. I hope you can assist me. Thank you very much.