Stock Portfolio Organizer

The ultimate porfolio management solution.

WiseTrader Toolbox

#1 Selling Amibroker Plugin featuring:

TD Sequential for Amibroker (AFL)

TD Sequential.

TD Points.

TD Setup Trends.

By AbdulKareem – AlGhamdi1 [at] hotmail.com

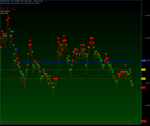

Screenshots

Indicator / Formula

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 | _SECTION_BEGIN("TD Systems");// ParametersShowNumbers= ParamToggle("Show 1-8 Numbers","No|Yes", 1);ShowTDPoints = ParamToggle("Show TD Points", "No|Yes", 1);ShowTDST = ParamToggle("Show TD Setup Trend", "No|Yes", 1);tdstsa = 0;tdstba = 0;///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////********************************************** TD Points********************************************************************/function TD_Supply(){ return ( H > Ref(H, 1) AND H > Ref(H, -1) AND H > Ref(C, -2));}function TD_Demand(){ return ( L < Ref(L, 1) AND L < Ref(L, -1) AND L < Ref(C, -2));}/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// *********************************************** TD Sequential************************************************************/// *** Setup Buy Signal ***//nine consecutive days closes less than the close four days earlierCon = C < Ref( C, -4);Buy9Bars = BarsSince(BarsSince(Con));Buy9Signal = Buy9Bars == 9;// *** Requirements ***//The first day of the nine-day must be preceded by a close day immediately before it that is greater than OR equal to the Close four days earlierCon = Ref(C, -9) >= Ref(C, -13);Buy9Req = Buy9Signal AND Con;// *** Intersection ***// the high of either day 8 or day 9 is greater than or equal to the low three, four, five, six, OR seven days earlierCon1 = (H >= Ref(L, -3)) OR ( Ref(H, -1) >= Ref(L, -3));Con2 = (H >= Ref(L, -4)) OR ( Ref(H, -1) >= Ref(L, -4));Con3 = (H >= Ref(L, -5)) OR ( Ref(H, -1) >= Ref(L, -5));Con4 = (H >= Ref(L, -6)) OR ( Ref(H, -1) >= Ref(L, -6));Con5 = (H >= Ref(L, -7)) OR ( Ref(H, -1) >= Ref(L, -7));Buy9Intr = Buy9Req AND (Con1 OR Con2 OR Con3 OR Con4 OR Con5);/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// *** Setup Sell Signal ***//nine consecutive days closes greater than the Close four days earlier.Con = C > Ref( C, -4);Sell9Bars = BarsSince(BarsSince(Con));Sell9Signal = Sell9Bars == 9;// *** Requirements ***//The first day of the nine-day must be preceded by a Close day immediately before it that is less than the Close four days earlierCon = Ref(C, -9) < Ref(C, -13);Sell9Req = Sell9Signal AND Con;// *** Intersection ***//the low of either day 8 or day 9 is less than or equal to the high three, four, five, six, OR seven days earlierCon1 = (L <= Ref(H, -3)) OR ( Ref(L, -1) <= Ref(H, -3));Con2 = (L <= Ref(H, -4)) OR ( Ref(L, -1) <= Ref(H, -4));Con3 = (L <= Ref(H, -5)) OR ( Ref(L, -1) <= Ref(H, -5));Con4 = (L <= Ref(H, -6)) OR ( Ref(L, -1) <= Ref(H, -6));Con5 = (L <= Ref(H, -7)) OR ( Ref(L, -1) <= Ref(H, -7));Sell9Intr = Sell9Req AND (Con1 OR Con2 OR Con3 OR Con4 OR Con5);/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////if(StrToNum(NumToStr(Buy9Intr))) Sell9Intr = False;if(StrToNum(NumToStr(Sell9Intr))) Buy9Intr = False;BuySignal = Flip(Buy9Intr, Sell9Intr);/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// *** Buy Countdown ***//With respect to a pending Buy Signal, the close must be less than the low two days earlier; Con = C < Ref(L, -2);Buy13Count = Sum(Con AND BuySignal, BarsSince(Buy9Intr));Buy13Signal = Buy13Count == 13;/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// *** Sell Countdown ***//with respect to a pending Sell Signal, the Close must be greater than the High two trading days earlier.Con = C > Ref(H, -2);Sell13Count = Sum(Con AND NOT BuySignal, BarsSince(Sell9Intr));Sell13Signal = Sell13Count == 13;///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////*********************************************** TD Sequential Plotting area *************************************************/Plot(C, "", IIf(O>=C, colorRed, colorGreen), styleBar);PlotShapes(IIf(Buy9Intr OR Sell9Intr, shapeDigit9, shapeNone),colorBlue, 0, H,20);if(ShowNumbers)PlotShapes(IIf(Buy9Bars==1, shapeDigit1, IIf(Buy9Bars==2, shapeDigit2, IIf(Buy9Bars==3, shapeDigit3, IIf(Buy9Bars==4, shapeDigit4, IIf(Buy9Bars==5, shapeDigit5, IIf(Buy9Bars==6, shapeDigit6, IIf(Buy9Bars==7, shapeDigit7, IIf(Buy9Bars==8, shapeDigit8, IIf(Buy9Bars >9, shapeStar,shapeNone))))))))),colorGreen, 0, H, H*.001);if(ShowNumbers)PlotShapes( IIf(Sell9Bars==1, shapeDigit1, IIf(Sell9Bars==2, shapeDigit2, IIf(Sell9Bars==3, shapeDigit3, IIf(Sell9Bars==4, shapeDigit4, IIf(Sell9Bars==5, shapeDigit5, IIf(Sell9Bars==6, shapeDigit6, IIf(Sell9Bars==7, shapeDigit7, IIf(Sell9Bars==8, shapeDigit8, IIf(sell9bars>9, shapeStar,shapeNone))))))))),colorRed, 0, H, H*.001);Sell = Sell13Signal AND NOT BuySignal;Buy = Buy13Signal AND BuySignal;Sell = ExRem(Sell, Buy);Buy = ExRem(Buy, Sell);PlotShapes(Sell*shapeDownArrow, colorYellow, 0, H, -H*.001);PlotShapes(Buy*shapeUpArrow, colorBrightGreen, 0, L, -L*.001);if(StrToNum(NumToStr(BuySignal)))bgColor = ColorRGB(0,66, 2);elsebgColor = ColorRGB(66,2, 0);SetChartBkGradientFill( colorBlack, bgColor);///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////*********************************************** TD Points Plotting area*************************************************/if(ShowTDPoints){PlotShapes(TD_Supply()*shapeSmallCircle, colorRed, 0, H, H*.001);PlotShapes(TD_Demand()*shapeSmallCircle, colorGreen, 0, L, -L*.001);///////////////////////////////////////////////////////////////////////////y0 = StrToNum(NumToStr(ValueWhen(TD_Demand(), L)));x = LineArray(0, y0, (BarCount-1), y0);Plot(x, "", colorGold, styleDashed);y0 = StrToNum(NumToStr(ValueWhen(TD_Supply(), H)));x = LineArray(0, y0, (BarCount-1), y0);Plot(x, "", colorGold, styleDashed);}///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////*********************************************** TDST Plotting area*************************************************/// ---------------->>>> Code from Dave <<<----------------------//if(ShowTDST){tdstba =Cum(0);tdstb = Null;HHV9 = HHV(H,9);for (i = 0; i < 10; i++) tdstba[i] = Null;for( i = 10; i < BarCount; i++ ) { if (Buy9Bars[i] == 9) { HHV_b = HHV9[i]; if (HHV_b > C[i-9]) tdstb = HHV_b; else tdstb = C[i-9]; for (j = 0; j < 9; j++ ) tdstba[i-j] = tdstb; } else tdstba[i] = tdstb;}tdstsa =Cum(0);tdsts = Null;LLV9 = LLV(L,9);for (i = 0; i < 10; i++) tdstsa[i] = Null;for( i = 10; i < BarCount; i++ ) { if (Sell9Bars[i] == 9) { LLV_b = LLV9[i]; if (LLV_b < C[i-9]) tdsts = LLV_b; else tdsts = C[i-9]; for (j = 0; j < 9; j++ ) tdstsa[i-j] = tdsts; } else tdstsa[i] = tdsts;}Plot(tdstba, "TDSTb", colorBlue,styleStaircase | styleThick|styleDots);Plot(tdstsa, "TDSTs", colorRed,styleStaircase | styleThick|styleDots);}/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////Title = "{{DATE}} - "+Name()+" ("+ FullName()+ ") - "+" Open="+O+",High="+H+", Low="+L+", Close="+C+StrFormat(" (%.2f %.1f%%)",IIf(ROC(C,1)==0,0,C-Ref(C,-1)),SelectedValue( ROC( C, 1 )))+"\n"+EncodeColor(colorBlue) +"TDST Buy = " +WriteVal(tdstba, 5.2) +""+EncodeColor(colorRed) +"TDST Sell = " +WriteVal(tdstsa, 5.2)+"\n"+EncodeColor(colorGold)+WriteIf(BuySignal, "(Buy SignalActive:"+Buy13Count, "(Sell Signal Active: "+Sell13Count)+")";_SECTION_END(); |

2 comments

Leave Comment

Please login here to leave a comment.

Back

Please explain how to use this indicator in trading.

Under the chart of the following site are two PDF files which explain the indicator TDM Sequential in great detail much better then I ever could. It explains almost every aspect of it.

Click here to go to the site

PS. Don’t use all capital letter when posting because that means your shouting.